How long will it take to save for a deposit in London?

The struggle for first time buyers is something we’re all acutely aware of, but many of us don’t realise just how long it could take to save up for that deposit. Is there any hope without the bank of Mum and Dad? The short answer is yes, for some.

Back in the 1960’s and 70’s house prices were extremely affordable. The baby boomer generation had it easy. Three-bedroom semi-detached houses were going for as little as £4000. £4000 only covers a fraction of the deposit in today’s housing market.

To make matters worse, banks make it difficult for first-time buyers to get a mortgage without a sizeable deposit – typically 25% of the asking price. Some banks are offering mortgages with a 5% deposit, whilst others are as high as 40%. However, the general consensus is mortgages are hard to come by these days.

In just fifty years, the generation divide in the UK has switched from baby boomers to the ‘boomerang generation.’ University leavers move out, they find themselves so swamped in debt that they realise they cannot afford to live independently, and move straight back in with their parents. Any savings they could make from their salaries often goes on paying back student loans. Meanwhile, with record low interest rates and inflation rising, savers are seeing their money slowly erode. The wealth gap between generations just keeps growing.

How many years could it take?

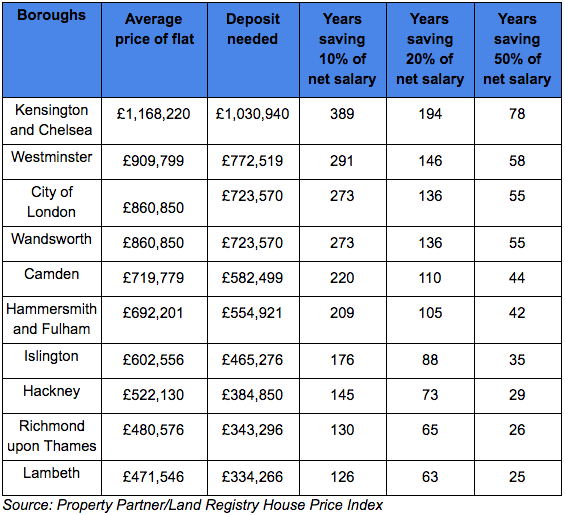

We’ve conducted some research (as featured in the Telegraph), which shows the number of years it would take for a worker in London on an average salary of £34,320 to save up for a deposit on a flat, assuming that their savings grow at the same rate as property prices do in those years.

Here are London’s most expensive boroughs:

Meanwhile, the following table shows the London boroughs where it would take the least number of years to save the deposit for an average price flat:

Realistically, a person on the average salary can only save between 10 and 20 per cent to keep up a decent quality of life. Even in the ten most affordable boroughs you’d need to be saving an ambitious 20% of your net annual salary to stand a chance of getting the deposit together before you reached middle age. Meanwhile, if you’re not making investments that at least track growth in property prices, the story is even bleaker.

So what are the options?

Clearly, it’s essential to look for investments that can expect to beat growth in the property market. Historically, residential property is a far stronger performer in the long term than other types of investment, so this is likely to be difficult without expert knowledge.

With Property Partner, you can expect your savings to at least track movements in property prices, with the added bonus of rental income. If we add rental income of 3.5% on top of this, the average time it would take for a person on the average salary in London to save for their deposit would fall from 121 years to 47 years.

For those who cannot expect to exceed the average salary in London, homeownership may not be a realistic prospect in London itself, though the market isn’t closed to them completely if they hope to own elsewhere. Through services like Property Partner, everyone can feel the stability of homeownership by investing their savings into bricks and mortar, with the additional bonus of rental income on those investments.

Those with prospect of a higher salary can look to homeownership as something achievable, albeit distant. To speed up the process, they must look for other ways to ensure that their savings keep pace with (or outstrip) growth in the property market. Parents looking to help their children may even want to consider saving from birth, setting aside a small amount each month as some parents do for education.

Search our properties to find opportunities that suit your investment goals.

Let sellers know the price you’d pay for a property, and how much you’d like to buy.